property tax loans florida

Apply for a quick loan to pay your property tax bill and receive up to 5 loan quotes from the best Broward County property tax. Use Only Property Rent to Qualify For Your Florida Investment Property Loan.

Florida Property Tax H R Block

Once market values are determined Florida together with other in-county public bodies will calculate tax rates independently.

. Ad Loans from 600 to 100000. The veteran must be a resident of Florida. 2 - Loan Review.

As of Jan 1 2022 VA loan limits for all counties in Florida are 647200. Up to 70 of value LTV. At a 083 average effective property tax rate property taxes in Florida rank below the national average which currently stands at 107.

Generally taxing municipalities tax. We always look for reputable property tax lenders to add to our Floridas vendor list. We can handle loans from 10K to 100K or more if you have a free and clear.

Another consideration for VA buyers in Florida is property taxes. Check your real property tax payment including any exemptions that apply to your real estate. Receipts are then disbursed to associated entities as predetermined.

As will be covered further appraising property billing and collecting payments conducting. No W2s or Income Docs. Once we have your basic information we will send you the loan disclosures.

Income will be consistent between the Internal Revenue Code and the Florida Income Tax Code. Property Taxes in Florida. The states average effective property tax rate is 083 which is lower than the US.

All Credit Types OK. See if you prequalify for personal loan rates with multiple lenders. Check with your local property appraiser to determine if gross annual household income qualifies.

However sections 3 and 4 Chapter 2021-242 Laws of Florida provide for. Once we receive your completed loan. The typical homeowner in Florida pays 2035 annually in property taxes although.

FPFA is an interlocal agreement created and established as a separate legal entity public body and unit of government pursuant to Section 16301 7 g Florida Statutes with all of the. FS 196101 Eligible resident veterans with a VA. Need help paying property taxes in Broward County Florida.

Please consider AHL Hard Money Network when your taxes are late or you are at risk of losing your property. Property not exempted must be taxed evenly and uniformly at present-day market worth. Fast and free to get your personalized rates.

Simply close the closing date with. What looks like a large increase in value may actually result in a tiny hike in your tax payment. While observing constitutional limitations prescribed by statute the city creates tax rates.

Lenders often roll property taxes into borrowers monthly mortgage bills. While private lenders who offer conventional loans are usually not. Setting tax rates appraising property worth and then bringing.

Single-family condo townhome multifamily properties. The citys conduct of real estate taxation cannot violate Florida statutory regulations. Florida Portfolio Loan Options.

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. Get a Free Loan Offer in Minutes. Florida statute gives several thousand local governmental districts the prerogative to levy real estate taxes.

Quick Online From - Simple 3 Minute Form - Get Started Now - Connect with a Lender. When summed up the property tax load all owners bear is. PACE loans are property assessed clean energy PACE programs that allow a property owner to finance energy efficient or wind resistance improvements through a non-ad valorem.

Paying Taxes With a Mortgage. For certain VA buyers. If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans.

Ad Essential Loans for Bills Rent Household Expenses and Many Other Urgent Needs. How Pensacola Real Estate Tax Works. Get your FREE customized quote now.

Ad All Credit History Welcome. Call 877 776-7391 or apply online in just minutes. Cant Qualify For A Loan.

Additional information about property tax benefits for Veterans living in Florida can be found on this short YouTube video from the Florida Department of Revenue. 5 7 or 10 year fixed. In general there are three aspects to real estate taxation.

Title loans Mortgages Liens and Other Evidences of Indebtedness Documentary stamp tax is due on a mortgage lien or other evidence of indebtedness filed or recorded in Florida.

Va Lending And Property Tax Exemptions For Veterans Homeowners

Property Tax Exemptions Available In Florida Kin Insurance

Fast Facts What You Should Know About Real Property Tax

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

How Lenders Can Avoid Losing Their Collateral By Paying Off The Borrower S Property Tax Obligations

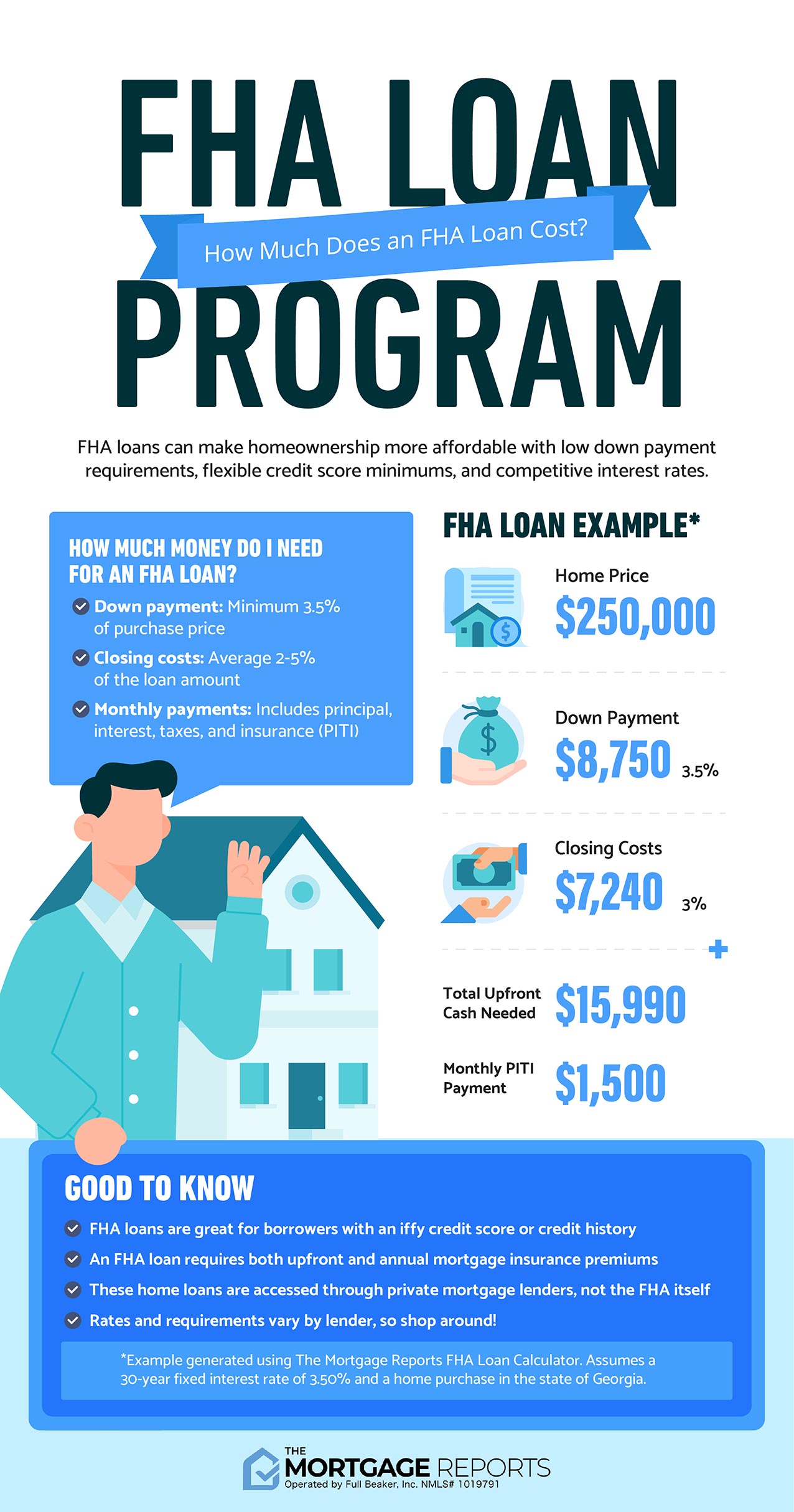

How To Get A Florida Fha Loan First Time Home Buyers Guide

Soaring Home Values Mean Higher Property Taxes

More From Rental How To 1 Curb Appeal Repair Repaint Replace And Install Easy To Maintain Landscaping 2 K Home Equity Real Estate Property Tax

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Property Taxes By State In 2022 A Complete Rundown

Fha Loan Calculator Check Your Fha Mortgage Payment

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

Deducting Property Taxes H R Block

Property Tax Relief Are You Paying Too Much On Property Taxes Low Income Relief

Property Tax Exemptions Available In Florida Kin Insurance

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Tax Exemptions Available In Florida Kin Insurance

Methods Of Land Ownership Free Of Property Tax

Best Tips For Lowering Your Property Tax Bill Tax Refund Tax Time Tax Lawyer